will bank

Multiproduct Acquisition Experience

Redesigning will bank’s onboarding to move from a credit-only entry to a multiproduct experience: increasing conversion, trust, and brand perception.

My roles

Design Strategy + Discovery + Information Architecture + User Flow + User Research + Wireframes + Prototyping + Usability Testing + Content

Overview

will bank is a Brazilian fintech focused on democratizing financial access.

In 2025, as credit approval rates dropped across the industry, most new users came looking for a credit card, but only a few were approved.

To keep growing, we redesigned the onboarding experience to go beyond credit, creating a multiproduct journey that lets people discover and start using will’s products from day one.

Context

For years, will’s acquisition funnel was centered around the credit card, creating high drop-offs and limiting who could actually become a client.

Business pain:

Because our current sign-up flow primarily allows users to apply for the credit card, anyone who arrives through a campaign for another product (like FGTS, will pay, or investments) can’t choose that product to start their relationship with will.

This structure restricts our acquisition potential and prevents other products from growing.

User pain:

Through store reviews and community feedback, many users expressed that they would like access to other products and don’t always want to start their relationship with will through a credit card.

Some also mentioned seeing value in other products, such as will pay, savings, or FGTS, and wished they could start directly from them.

We needed to reposition onboarding to reflect what will truly is: a complete financial ecosystem, not just a credit provider.

Goals

Increase conversion and activation among new and declined users.

Help people discover non-credit products early in the journey.

Reduce dependency on credit as the main entry point.

Strengthen trust and brand perception through a clearer, more transparent experience.

Solution

We designed a new onboarding model focused on choice and discovery.

The experience was structured in three steps:

Portfolio Screen — cards presenting products like FGTS, will pay, and investments during onboarding

Pre-login exploration (showcase) — users can explore the app before registering, seeing the home and how the products work

Cross dynamics — explore with other teams how to highlight their products

Together, these initiatives turned the onboarding into a real gateway to the will ecosystem, not just a credit funnel.

Strategy

Before this project, there was no previous work or clear direction around multiproduct onboarding at will. We were starting from scratch, no benchmarks, data, or defined approach to guide the experience.

To build this foundation, we combined market research, user insights, and iterative testing:

We benchmarked 19 local and global players to understand how other banks introduce multiple products during onboarding;

We ran surveys with 2,800+ users to learn what they expected from will’s ecosystem and how they perceived non-credit products;

Together with the Research team, we conducted qualitative interviews to go deeper into motivations, trust, and barriers;

We ran usability tests on the “pre-login exploration” prototype to validate comprehension and motivation before account creation;

Finally, we supported each phase with A/B experiments to measure the real impact on conversion and engagement.

This mix of discovery, research, and testing helped us move from uncertainty to a clear strategy, turning an undefined space into a structured product vision for multiproduct onboarding.

Design Process

Benchmark

We started by looking at the market.

Together with the team, I led a benchmark study of 19 players, including digital banks, fintechs, and financial big techs, to understand how other brands approach onboarding when they offer more than one product.

We analyzed five key aspects for each player:

Which product starts the flow (credit card, account, investment, etc.)

How many products are offered during onboarding

Data required in the form (fields and effort)

Average time to complete the sign-up

If and how cross-sell appears at the beginning of the journey

What we found was clear:

Most fintechs start with a “create your account” step and only show other products after login;

In some cases, the credit card is the only product mentioned during onboarding;

Only a few players, like Revolut, C6 Bank, and Inter, use onboarding as a showcase for their ecosystem;

Brands that combine visuals, motion, and short messages to highlight benefits early create stronger brand recall;

CTAs like “Open your account” or “Create your free account” perform better than generic options such as “Sign up”;

Clear information, conversational tone, and friendly language build more trust and fluency.

User Research and Surveys

After the benchmark, we needed to understand our users’ expectations and perceptions.

We partnered with the Research team to run a quantitative survey with 2,800+ people, including both approved and declined users.

Our goal was to explore:

What products caught users’ attention when they first heard about will;

What people expected to find in onboarding;

What influenced their decisions before starting the registration;

How declined users felt after not being approved.

Main Findings:

Credit is still the main entry point

94% discovered will bank through the credit card, but many also showed interest in savings, account, and personal loans;Security is a key concern

Over 80% of users researched will bank before signing up, mostly to confirm if it was safe and trustworthy;Trust exists, but confidence is fragile

84% agreed that will bank feels reliable, but many still needed proof before continuing.

This reinforced the need to test social proof and trust messages in onboarding;Expectation of full access

8 in 10 users believed they would have access to all will bank products after registration, not only the credit card;High potential for diversification

81% said they want to use will bank beyond credit, but prefer simple and familiar entry points, like savings or Pix.

Key takeaway:

Credit denial remains the main barrier in acquisition, while security still plays an important role in users’ decision to start the journey.

These findings reinforced the need to offer new entry points beyond credit and build more trust within the onboarding experience.

Interviews

To go deeper, we ran qualitative interviews with approved and declined users to understand their motivations, trust levels, and perceived value of will’s products.

During this phase, I also created proto-personas based on behavioral patterns and attitudes observed in the research.

These personas helped us link real user needs to business pain points and gave the team a shared language to discuss priorities.

They also became key artifacts when presenting findings to stakeholders, helping to ground our design recommendations in human stories rather than just data.

Key learnings:

Trust and clarity are key triggers for conversion. People want to know “what’s in it for me?” before sharing personal data;

Declined users often had positive feelings about will bank, but felt frustrated after a “no” because they didn’t see other ways to continue;

Most users discovered will through ads or word of mouth, but couldn’t clearly describe what the brand offered beyond the credit card;

Many said they would have continued if they had seen other product options or could explore the app before signing up.

💬 “I didn’t mind being declined — I just didn’t see another reason to stay.” Said one of our intervieews

These insights helped us redefine onboarding not as an approval process, but as an invitation to explore will’s full ecosystem.

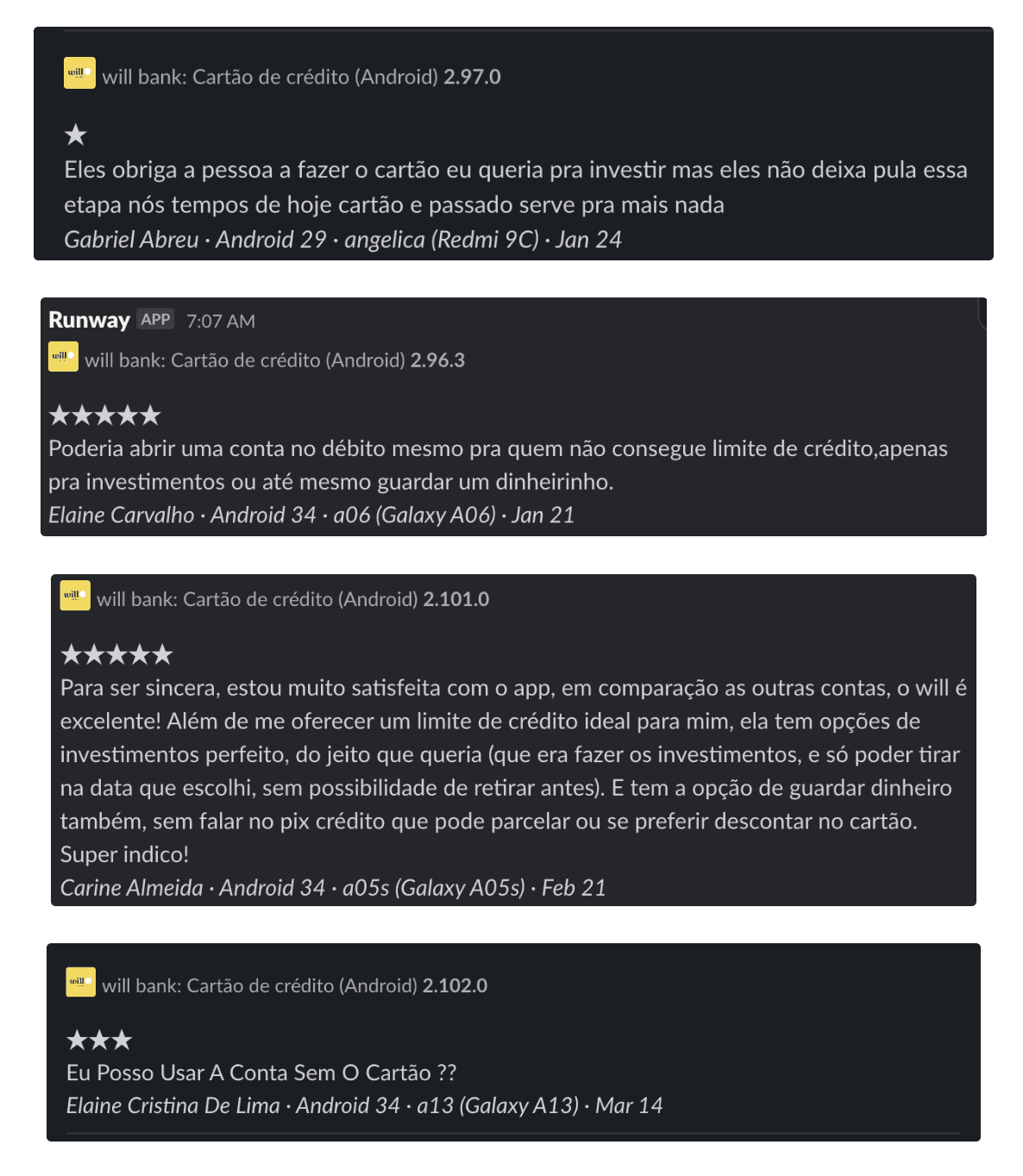

Store Review Analysis

We also monitored Google Play and App Store reviews to understand how users were talking about will. This helped us collect honest feedback from both new and declined users.

Most negative reviews came from declined users, who said they liked the brand but felt stuck after being denied, with no clear alternative to continue.

Others mentioned wanting access to different products, like the account, FGTS, or investments, instead of starting only with the credit card.

At the same time, positive comments from approved users reinforced will’s strengths around trust and simplicity.

User Flow

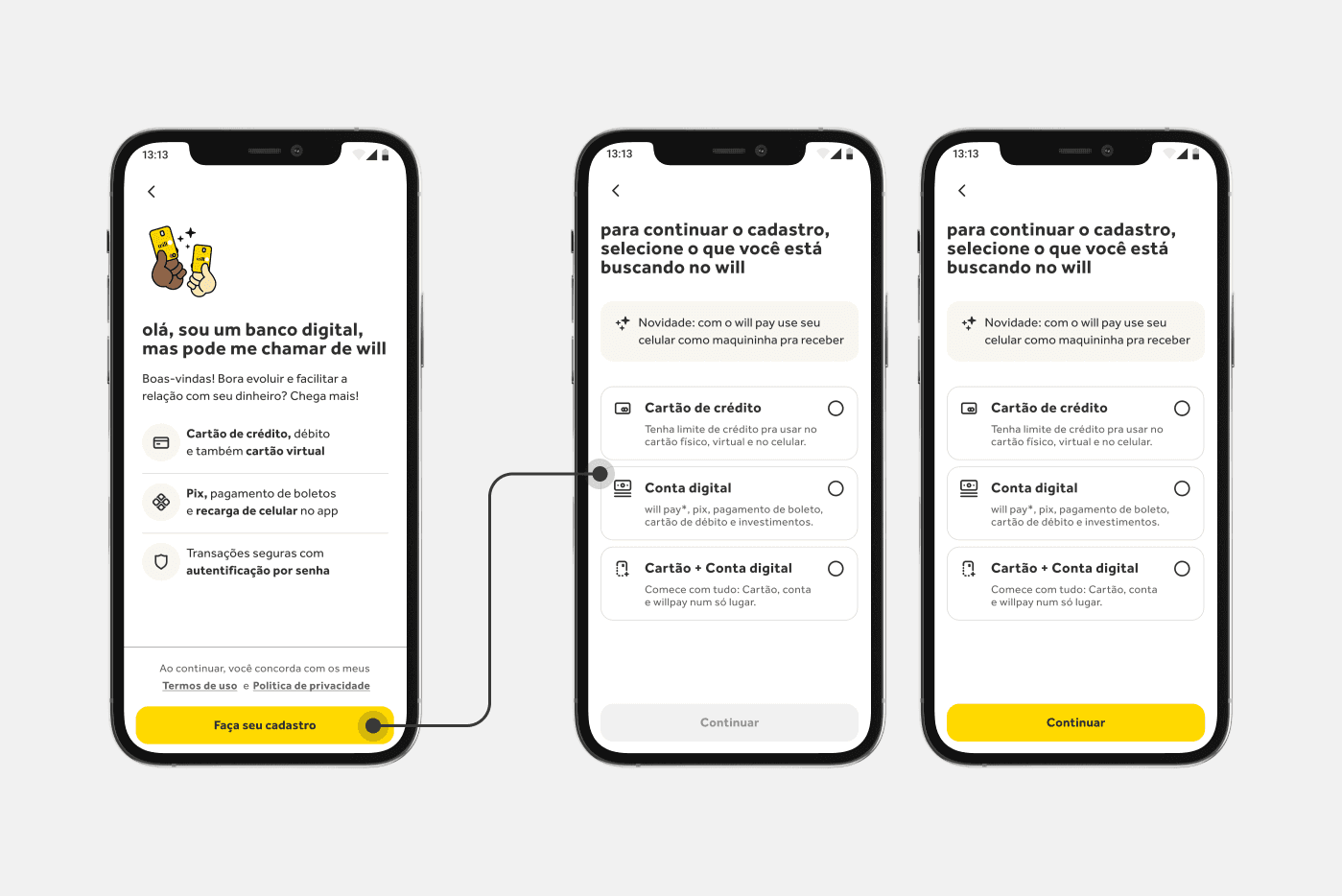

We started by redesigning the first step of the onboarding to understand user intent.

The new flow asked: "Which product are you most interested in?”

People could choose between Credit Card, Account, FGTS, Investments, and will pay, but at this stage, the selection didn’t change the journey yet.

Regardless of their choice, users were still redirected to the existing credit or account flow, once they enter the app, they can activate or explore the products they previously selected.

The goal was to measure interest and learn how people reacted when presented with multiple entry options.

Prototypes

The prototype was a simple screen of product cards with short, neutral copy and visual balance to avoid bias.

Two versions were created:

One including Colateral/Plim;

One excluding it to see if the extra option would make users select everything.

The interaction was purely informative, users could select multiple products, but their choice didn’t alter the next step yet.

This version allowed us to measure demand distribution, perceived clarity, and engagement with multiproduct entry.

Implementation Process

ABC Test

Apr 2-21, 2025

We ran two cycles (with and without randomization) to validate the effect of adding the product-selection screen.

Regardless of choice, users continued to the standard credit or account flow.

Goal:

Understand if asking about product interest would increase completion of the onboarding steps and reveal demand patterns.

Results:

+2 to +3.5 pp increase in Start/Proposal across all segments;

“Excluding Colateral” version performed better, reducing “select all” bias;

Top selections: Credit (50%), Credit + Account (13%), All options (10%), Account only (5%);

Seven combinations represented 95% of total responses.

The test validated that simply asking about product interest already increased engagement even without changing the journey.

A/B Test May 16-24, 2025

In the second phase, we tested a new version of the product-selection screen to better reflect will’s ecosystem and user base.

Since most of our audience is self-employed or entrepreneurial, we decided to highlight will pay, a feature that turns the phone into a digital payment terminal, allowing users to receive payments directly from clients.

We also refined the structure of the product cards to make the message clearer and connect more naturally to the existing flows.

Users could now choose between:

Credit Card — traditional entry for those seeking credit;

Digital Account — emphasizing other products available inside the app, such as will pay, investments, and savings;

Credit Card + Account — for users interested in the complete experience.

The goal of this test was to understand if emphasizing the account as a gateway to other products, especially will pay, could improve engagement and conversion among users with a self-employed profile.

Results:

+2.2 pp increase in Start/Account Created (18.1% > 20.3%), with statistical confidence.

“Account-only” selections increased (15.4% > 17.6%), while credit remained stable (2.68% > 2.78%);

CSAT remained consistent (4.43);

Slight increase in support chats (+7.9%), mostly from users expecting to access credit directly from the account, highlighting the need to improve communication around product activation order.

Adding will pay as a visible option helped connect with the entrepreneurial segment and positioned the account as a more valuable entry point, even without changing the flow itself.

Launch strategy

We used a phased rollout to monitor results and control risk:

Results

Hypothesis

We started from the hypothesis that:

Results

What we observed:

Next Steps

Home Degustação (pre-login onboarding)

After validating that product visibility increased engagement, our next step is to test a pre-login onboarding, internally called Home Degustação.

The idea is to let users explore a “demo” version of the app before creating an account, experiencing real products and understanding what will offers beyond credit.

This test was designed to address two main gaps we identified:

Credit denial as a dead end: users who aren’t approved often leave because they don’t see other ways to continue.

Low perceived value before signup: many people don’t realize the variety of products until after account creation.

By letting them explore first, we aim to build trust, curiosity, and motivation earlier in the journey.

Hypothesis

Usability tests

We tested the first prototype of this experience, including declined, entrepreneurial, and digital-native users.